Spilltekno – Spilltekno – Tabular valuation is a crucial method in financial analysis, widely used in various industries, including investment, insurance, and real estate. This approach helps professionals determine the present and future value of assets, ensuring informed decision-making.

In this article, we’ll explore the fundamentals of this valuation method, its significance in financial planning, and how businesses and individuals can leverage it to assess risks and opportunities. We’ll also provide practical examples, supporting data, and expert insights to strengthen your understanding.

What is Tabular Valuation?

This financial technique utilizes predefined tables to estimate values related to investment returns, annuities, depreciation, or actuarial calculations. These tables act as convenient references for determining monetary figures without requiring complex calculations.

Key Applications of Tabular Valuation:

- Insurance Industry: Used to determine policy values and premium calculations.

- Real Estate: Helps in assessing property depreciation over time.

- Pension Funds: Assists in evaluating retirement payouts based on expected lifespans.

- Investment Analysis: Supports decision-making in long-term financial planning.

By using structured valuation tables, financial analysts can streamline assessments, ensuring accuracy and efficiency in evaluating present and future monetary values.

How Tabular Valuation Works

Components of a Tabular Valuation Table

A tabular valuation typically consists of:

| Component | Description |

|---|---|

| Discount Rate | Interest rate used to calculate present values. |

| Future Value Factor | Multiplier to determine the future worth of investments. |

| Present Value Factor | Used to compute the current worth of future cash flows. |

| Depreciation Factor | Helps determine asset depreciation over time. |

| Mortality Tables | Used in actuarial calculations for insurance policies. |

Example Calculation

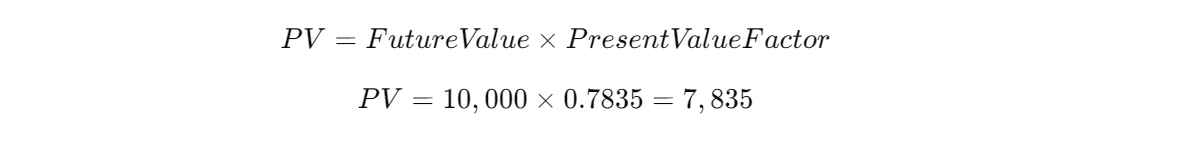

Suppose you want to determine the present value of a $10,000 investment expected in 5 years at a discount rate of 5%. Using a present value factor of 0.7835 from a standard financial table, the calculation would be:

This means the current value of the $10,000 investment is $7,835 when discounted at a 5% rate over five years.

Importance of Tabular Valuation in Financial Decision-Making

1. Simplifies Complex Calculations

Instead of manually computing values using compound interest formulas, professionals can use pre-calculated tables for quick assessments.

2. Enhances Accuracy in Financial Planning

Using tabular valuation, businesses and investors can avoid miscalculations that could impact long-term financial stability.

3. Reduces Decision-Making Errors

By following standardized valuation metrics, companies can minimize risks associated with mispriced investments or miscalculated insurance policies.

4. Ensures Regulatory Compliance

Many financial institutions and government bodies rely on tabular valuation tables to ensure consistency in tax, insurance, and pension-related calculations.

Tabular Valuation vs. Other Valuation Methods

Comparison of Valuation Techniques

| Method | Application | Pros | Cons |

|---|---|---|---|

| Tabular Valuation | Insurance, investments, annuities | Quick calculations, standardized, widely accepted | Limited flexibility, dependent on fixed rates |

| Discounted Cash Flow (DCF) | Investment and business valuation | Highly accurate, considers variable cash flows | Complex, requires detailed projections |

| Comparable Market Analysis | Real estate, stock valuation | Market-driven, easy to understand | Market fluctuations can impact results |

| Cost-Based Valuation | Asset depreciation, infrastructure projects | Tangible assessment, reliable for fixed assets | Ignores market demand and external factors |

From the table above, this method is ideal for standardized assessments but may lack flexibility compared to more dynamic approaches like DCF analysis.

Best Practices for Using Tabular Valuation

To maximize the effectiveness of tabular valuation, consider the following best practices:

- Ensure Updated Data: Use the latest valuation tables to reflect accurate interest rates and economic conditions.

- Combine with Other Valuation Methods: For a well-rounded analysis, complement tabular valuation with DCF analysis or comparative market valuation.

- Understand Assumptions: Be aware of the interest rates, mortality rates, or depreciation factors used in the tables.

- Consult Experts: Financial advisors and actuaries can provide insights into interpreting tabular valuation results effectively.

Real-World Applications of Tabular Valuation

1. Life Insurance Policy Calculation

Insurance companies use mortality tables to determine premium rates. If a policyholder has a 20-year term policy, insurers rely on actuarial calculations to assess risk and payout probabilities.

2. Retirement Planning

A retiree planning a 30-year annuity withdrawal can use tabular valuation to estimate future payouts based on an assumed rate of return.

3. Investment in Bonds

Bond investors rely on present value tables to evaluate whether a bond’s future interest payments justify its current price.

4. Property Depreciation

Real estate professionals use depreciation tables to calculate the declining value of properties for tax purposes.

Future Trends in Tabular Valuation

1. AI and Machine Learning Integration

New technologies are improving financial assessment methods by integrating predictive analytics, leading to greater precision in valuation processes.

2. Real-Time Data Updates

Dynamic tables that adjust to live interest rate changes are being developed to improve valuation precision.

3. Blockchain for Secure Valuation Data

Financial institutions are exploring blockchain technology to maintain transparent, immutable valuation records.

Tabular valuation is an essential tool in financial planning, offering a standardized, efficient approach to determining asset values, insurance premiums, and investment returns. While it may not be as flexible as advanced valuation models, its simplicity and reliability make it indispensable for professionals in finance, insurance, real estate, and retirement planning.

By utilizing structured valuation tables, individuals and businesses can make informed financial decisions, minimize risks, and adhere to industry standards.

🚀 Want to optimize your financial strategy? Start implementing smart valuation methods today! Share this article with your network and explore more insights on financial planning. Spilltekno

Simak update artikel pilihan lainnya dari kami di Google News dan Saluran Whatsapp Channel Spilltekno